|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

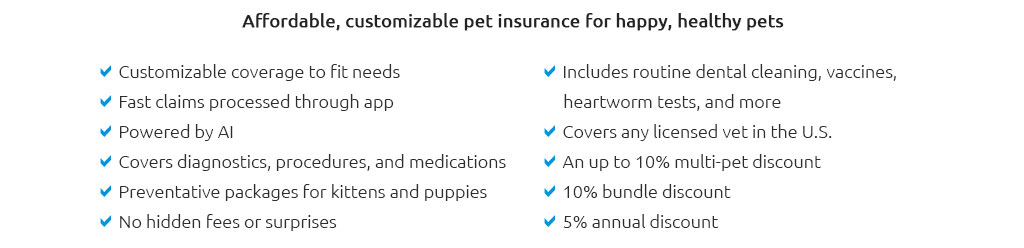

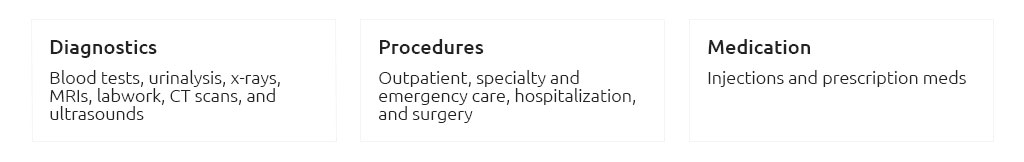

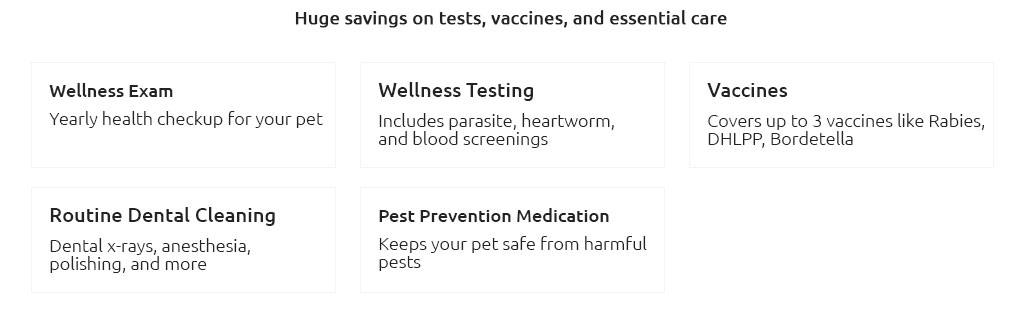

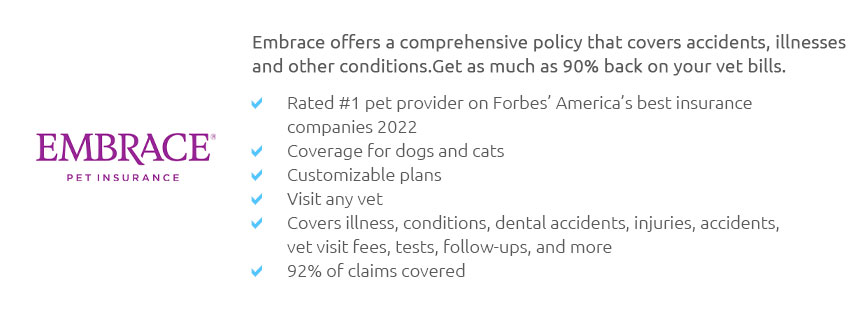

Understanding Pet Insurance: The Benefits of Low Monthly PaymentsAs more pet owners become aware of the rising costs associated with veterinary care, the concept of pet insurance has steadily gained traction. Among the various options available, policies offering low monthly payments have emerged as a particularly attractive choice for budget-conscious pet parents. But what exactly does 'pet insurance low monthly' entail, and how can it be beneficial to you and your furry friend? First and foremost, pet insurance with low monthly premiums provides a financial safety net that helps mitigate the risk of unexpected veterinary expenses. These policies work similarly to other types of insurance, where you pay a monthly fee in exchange for coverage on specific medical treatments and procedures. By opting for a plan with lower premiums, you can maintain a degree of financial flexibility while still ensuring your pet receives the necessary care when emergencies arise. This is particularly advantageous for pet owners who might otherwise struggle to cover the costs of sudden medical issues, which can often reach exorbitant amounts. One of the primary advantages of low monthly premium plans is their affordability. By spreading the cost over time, pet owners can manage their budgets more effectively without the burden of large upfront payments. This approach is particularly beneficial for those with multiple pets, as it allows for a manageable way to provide coverage for each animal. Moreover, these plans often come with customizable options, enabling you to tailor the coverage according to your pet's specific needs and your financial situation. It's important to note, however, that plans with low monthly payments might have higher deductibles or co-pays. This means that while the monthly outlay is lower, the costs you incur when making a claim could be higher. Thus, it is crucial to carefully review the terms of each policy and weigh the pros and cons based on your financial circumstances and your pet's health requirements. Additionally, some policies might have exclusions for pre-existing conditions or certain breeds, so a thorough understanding of what is covered is essential to avoid unpleasant surprises. Furthermore, investing in pet insurance is not just about the financial aspects; it’s a step towards peace of mind. Knowing that you have a safety net in place allows you to focus on your pet's wellbeing without the constant worry of potential financial strain. This can lead to a more relaxed and happier relationship with your pet, which is ultimately beneficial for both parties. In conclusion, pet insurance with low monthly payments can be an invaluable tool for ensuring your pet receives the care they need without imposing a significant financial burden. By choosing a plan that suits your budget and your pet's health needs, you can enjoy the reassurance that comes from being prepared for whatever life throws your way. However, as with any financial commitment, it is imperative to conduct thorough research and understand the terms of the policy to ensure it aligns with your long-term goals and requirements. Frequently Asked Questions

https://www.aspcapetinsurance.com/dog-insurance/

Complete Coverage SM for Dogs starting as low as $10/month. Complete Coverage SM plans cover Diagnostics Think X-rays, MRI, blood tests, urinalysis, ... https://www.nerdwallet.com/article/insurance/cheap-pet-insurance

Figo: Cheapest pet insurance for cats ... Why we picked it: Figo's overall average cost for cats was the lowest of all the companies we tested. https://www.pawlicy.com/blog/does-pet-insurance-with-no-deductible-exist/

Lower deductibles save money on initial upfront costs, but they frequently lead to higher monthly premiums. Conversely, high deductibles require you to pay more ...

|